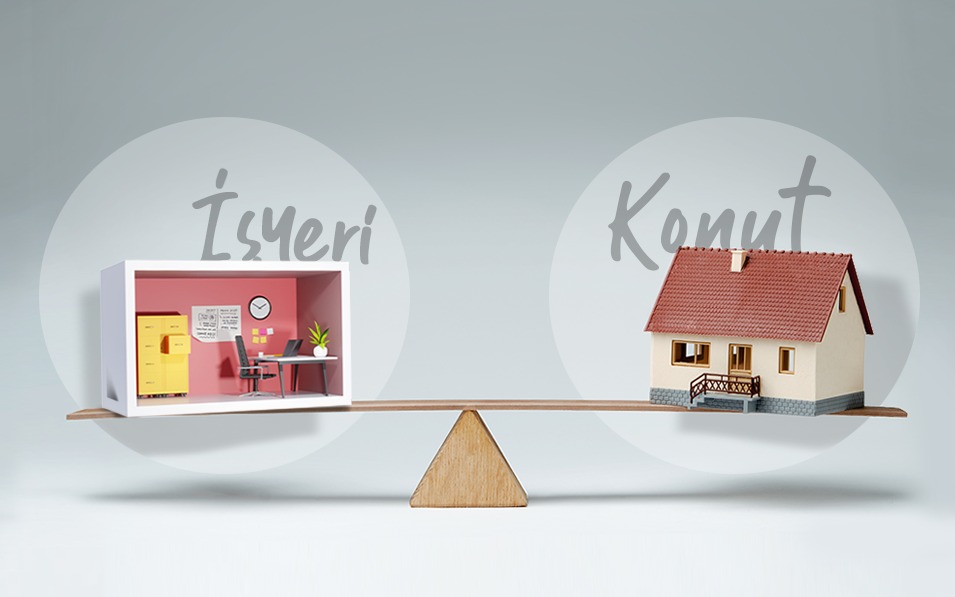

Residential or Commercial Real Estate Investment?

Anyone who wants to invest comes to the question of whether to buy an apartment, office or shop. In order to properly assess your savings, make a profitable real estate investment and avoid potential losses, you should evaluate the advantages and disadvantages properly.

The shop, which is a business in itself, is still a profitable investment tool. If you are engaged in trade, you are also aware that the general trend is in favor of the shop. When we examine the real estate investment value in terms of the rent multiplier, we see that the period of amortization for a house is 15-20 years, whereas it is 10-12 years in the shops.

Thanks to the rising trend of 1 + 1 and studio flats in recent years, investors are getting the return on their investments as a result of the rapidly rented houses in mass housing projects. Social spaces, shopping streets and shops created in mass housing projects have also become important investment tools. Because, even in a developing region, the lifestyle, demographic characteristics and socio-economic structures of people who are interested in site projects make it possible for the shops to have high sales potential and make them attractive.The advantages of workplace and shop over housing are that it can be rented at a higher price in a shorter period of time and that maintenance and repair costs are less than a house. But in the long run, when you question which one is a better investment tool, you need to consider your medium and long term plans.

For a safe and high profitable investment in the long term, a rentable shop within a living complex will definitely be the investment you are looking for. However, for a small-scale investor, such an investment may not be meaningful in a region where he is unsure of its location and return. In this case, in the long term, instead of shops and businesses, it is more reasonable to buy an apartment and invest in housing.